What Is Payment Optimization And Why Small Businesses Need It

How improving the way you accept payments can increase revenue, reduce stress, and keep your customers coming back.

- October 20, 2025

- Indra

- 8:08 am

The silent leak most small businesses do not notice

You work hard to bring in customers. You post, send emails, advertise, and build trust. People visit your site ready to buy. Then suddenly they disappear.

No message. No payment. Just gone.

It is easy to assume they changed their mind or that the economy is slow. In reality, the problem often sits right where the money moves. The payment process is the moment where excitement can turn into frustration.

For many small businesses this is the invisible leak that quietly drains profit each month. The checkout takes too long. The options are limited. The page feels insecure. These moments seem small but over time they cost real money.

Payment optimization fixes that. It is not about fancy software or complicated tools. It is about creating a payment experience that feels smooth, safe, and fast for your customers and effortless for you.

Let us look at what payment optimization means, why it matters, and how to put it to work even if you are not a technical person.

What you will learn

- What payment optimization actually means

- Why small businesses lose money without it

- The hidden friction inside checkout pages

- How trust signals turn browsers into buyers

- Making mobile payments effortless

- Using payment data and automation wisely

- Why payment speed shapes brand perception

- How recurring payments create stability

- Practical ways to optimize starting today

1. What payment optimization actually means

Payment optimization means making it simple, safe, and fast for people to pay you while ensuring you receive every payment efficiently.

Why this matters

Most small business owners treat payments as an afterthought. Yet the payment experience is part of your brand. When it feels smooth and reliable, customers complete their purchase confidently. When it feels slow or uncertain, they hesitate and leave.

The goal of optimization

- Increase completed checkouts

- Reduce abandoned or failed transactions

- Build trust through secure and transparent design

- Simplify how money reaches your account

In action

A fitness studio in Austin moved from manual bank transfers to Stripe. They added instant card checkout and automatic receipts. Within two weeks class bookings rose twenty eight percent because people could pay instantly instead of waiting for instructions.

Key takeaway Payment optimization removes barriers between interest and income.

2. Why small businesses lose money without it

Many entrepreneurs believe payment issues are rare. The truth is that small cracks in the system can cost large sums over time.

Why this happens

When you juggle marketing, service delivery, and daily operations, payments often get ignored. But outdated systems fail silently. Cards decline, invoices get delayed, or customers drop off because paying takes too long.

Common causes include limited payment options, manual invoicing, high processing fees, and confusing checkout pages that make people leave.

What this costs you

If your business earns ten thousand dollars a month, a five percent loss from failed or abandoned checkouts means five hundred dollars gone every month. That equals six thousand dollars in a year lost to inefficiency.

How to fix it

- Walk through your own checkout as if you were a new customer

- Offer trusted options such as Stripe, PayPal, or Google Pay

- Keep checkout to one clear page

Key takeaway Smooth payments increase profit without extra effort.

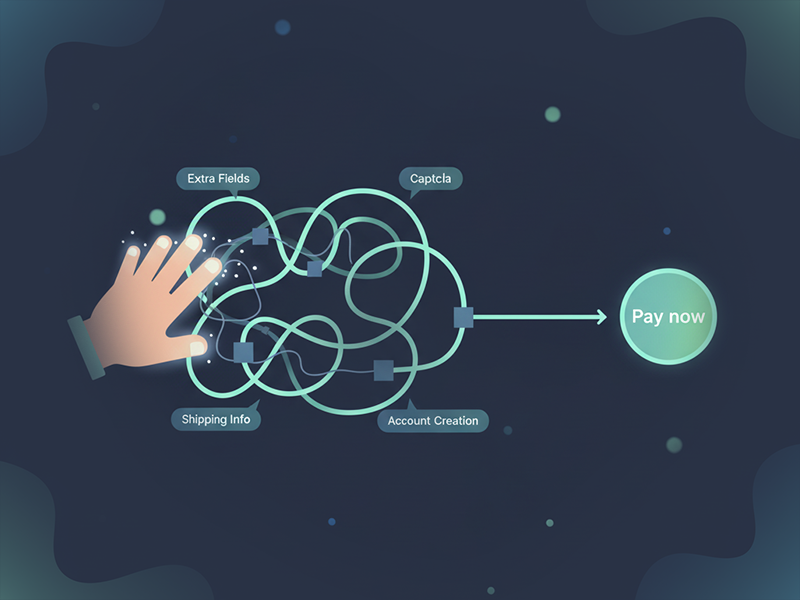

3. The hidden friction inside checkout pages

Friction is any moment of confusion, delay, or doubt that stops customers from completing a payment. It often hides where you least expect it.

Where friction appears

- Extra fields that ask for too much information

- Slow pages that make customers wait

- Redirects that break trust

- Forced account creation before paying

Each of these adds seconds to the process and those seconds cost conversions.

Why it matters

Studies from Baymard Institute show the average online cart abandonment rate is about seventy percent. Most drop-offs happen right before payment. Every bit of friction adds to that number.

How to remove friction

- Allow guest checkout and auto fill forms

- Use progress indicators so buyers know how close they are

- Keep the layout clean and consistent with the rest of your site

Case in point

A jewelry brand on Shopify once required account creation before checkout. After enabling guest checkout and saving card info for returning buyers, their conversion rate doubled from two to four percent in two months.

Key takeaway Every click you remove adds momentum and trust.

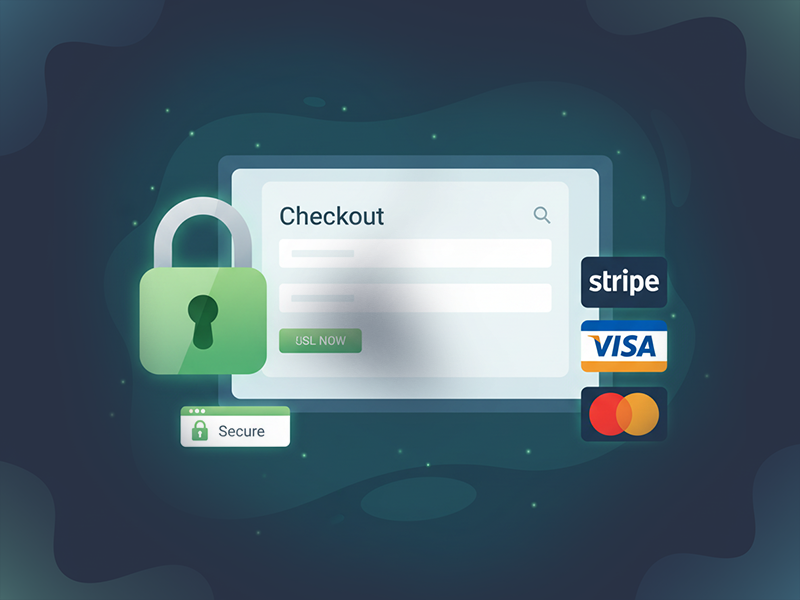

4. How trust signals turn browsers into buyers

Trust is what convinces people to finish a payment. Without visible proof of security, even eager buyers can hesitate.

Why this matters

When people pay online they want to feel safe. If anything looks uncertain they pause. That pause can mean a lost sale.

What to display

- SSL certificate and a visible lock icon

- Recognizable payment badges from Stripe, Visa, or MasterCard

- Clear refund or return policy near the checkout button

- Customer reviews or star ratings near payment fields

How this looked in real life

A marketing consultant added one short sentence below her form that read Payments processed securely by Stripe trusted by over one million businesses. Her checkout abandonment dropped seventeen percent overnight.

Key takeaway People buy safety and confidence as much as the product itself.

5. Making mobile payments effortless

More than sixty percent of online sales now happen on mobile devices. If your checkout does not work beautifully on a phone, you are losing revenue every single day.

Why this happens

Many business owners design their sites on computers and never test them on mobile. Buttons end up too small, text overlaps, or forms take too long to fill.

How to improve mobile experience

- Test your checkout on multiple screen sizes

- Enable Apple Pay, Google Pay, or PayPal

- Keep copy short and buttons clear

- Use vertical layouts for smooth scrolling

A story from a small business

A course creator selling through Gumroad noticed most of her traffic came from Instagram. After adding Apple Pay and changing her checkout button to Buy instantly, her mobile conversion rate rose thirty four percent.

Key takeaway Mobile optimization is where sales grow fastest.

6. Using payment data and automation wisely

Every transaction contains information about how your customers buy and where they hesitate. Payment data helps you make smarter decisions.

Why it matters

Understanding your payment patterns lets you forecast income and identify problems before they grow. It also helps you design smoother systems that build trust.

How to use data

- Track abandoned checkouts and send gentle reminders

- Highlight your most used payment methods

- Watch refund trends to uncover customer confusion

How automation helps

Platforms like Stripe, Square, and ThriveCart can retry failed payments automatically and send reminders when cards expire. They can also deliver receipts and confirmation emails instantly.

How this worked in practice

A design agency using subscriptions noticed failed renewals near card expiry dates. They added an automatic reminder three days before renewal. Payment failures dropped forty three percent within a month.

Key takeaway Data transforms guesswork into predictable cash flow.

7. Why payment speed shapes brand perception

Fast payments do not just improve cash flow. They change how people see your business.

Why this happens

When checkout or invoicing feels slow, it creates a sense of disorganization. Customers associate speed with professionalism and reliability.

What slows you down

- Manual invoicing

- Waiting for transfers

- Delayed confirmations

How to fix it

- Use instant payment links or automatic invoicing

- Connect payment tools to accounting apps like Notion or QuickBooks

- Send confirmation immediately after payment clears

In action

A photographer stopped using manual invoices and switched to Stripe payment links. Her clients began paying within an average of eighteen minutes instead of three days. Cash flow improved and clients praised her efficiency.

Key takeaway Fast payments build professional trust.

8. How recurring payments create stability

Recurring payments turn unpredictable revenue into consistent income that supports growth.

Why it helps

For you it means less stress. For your customers it means convenience because they do not need to remember to pay.

Common examples

- Monthly coaching or consulting retainers

- Membership programs and subscriptions

- Refill orders for physical products

How to start

- Use Stripe or PayPal for recurring billing

- Be transparent about renewal dates and cancellation options

- Offer small discounts for annual plans to encourage loyalty

Case in point

A nutrition coach used to send monthly invoices manually. After adding automated billing through Stripe, her collection rate rose from eighty two to ninety nine percent. She also saved six hours each month on admin work.

Key takeaway Predictable payments give your business stability and peace of mind.

9. Practical ways to optimize starting today

You can begin improving your payment system right now without hiring anyone.

Step by step approach

- Audit your checkout as if you are a new buyer

- Simplify your text and remove long instructions

- Add visible trust badges and refund details

- Enable mobile wallets for instant checkout

- Track conversion and completion rate monthly

Before and after transformation

Before A candle business asked customers to email orders and wait for invoices.

After They added Stripe checkout and mobile friendly pages with instant confirmation. Monthly revenue rose forty five percent without changing prices or marketing.

Key takeaway Payment optimization is one of the simplest ways to grow income quickly.

Bringing it all together

Payment optimization is not about trends. It is about clarity, trust, and flow.

When paying feels easy, customers return more often and talk about your business positively. You spend less time chasing payments and more time doing meaningful work.

Focus on these actions

- Remove unnecessary steps in checkout

- Offer multiple trusted payment options

- Strengthen refund transparency

- Enable one tap mobile payments

- Automate recurring billing for predictability

Each improvement compounds into a smoother, stronger business.

A simpler way forward

Optimizing payments is not a technical chore. It is an act of care for both your customers and yourself. When systems run smoothly, trust grows naturally and payments become stress free.

You do not need to change everything overnight. Start with small steps that make a visible difference. Every update adds confidence and flow to your business.

If you want a simpler way to organize your systems, track payments, and manage client experiences, visit Briefee. It helps small business owners and digital creators simplify their workflow, improve consistency, and keep everything running smoothly.

Your business does not need to work harder to earn more. It simply needs to flow better.

2025 © Briefee. All Rights Reserved.